A New Path to Freedom Awaits... Just Take This Pill and Proceed

I also don't have to be Albert Einstein to tell you it's a bad idea to be within five miles of a nuclear detonation.

What do I mean by "financial hell?"

Hell, for me, is lack of freedom. Lack of choice. Lack of movement, progression, development, and improvement.

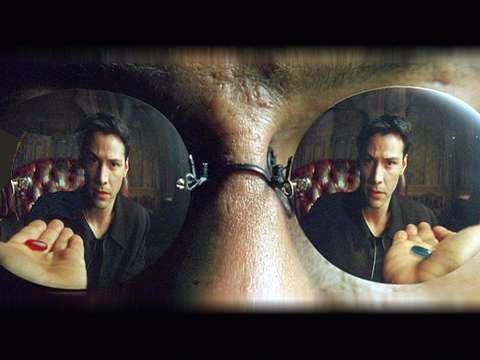

What do I mean by "financial shenanigans?" I'm referring to "The wool that has been pulled over our eyes to blind us to the truth... that we are slaves." (Thanks, Morpheus). I'm talking about the way our society has been brainwashed into a living as debt-serfs in a wasteful, entitled existence obsessed with having the best and latest "things" such as new cars, expensive toys, house, or Apple products, at the expense of things that make people truly happy.

What do I mean by "financial shenanigans?" I'm referring to "The wool that has been pulled over our eyes to blind us to the truth... that we are slaves." (Thanks, Morpheus). I'm talking about the way our society has been brainwashed into a living as debt-serfs in a wasteful, entitled existence obsessed with having the best and latest "things" such as new cars, expensive toys, house, or Apple products, at the expense of things that make people truly happy.Have you ever considered or contemplated how much of a financial LIE many of us in the western world live today? And do you believe it's true? If not, I recommend you reading this little gem I wrote recently about living a life based on reality instead of fantasy. Open it in a new tab, read it, then continue below.

Now that you'd done that, take the freaking red pill, which will lead to a life of educated bliss, and let's get on with this.

Rise Up and Revolt From Slavery

Loving and having things you don't need costs you your freedom.

Freedom can only be achieved once you have accumulated enough money, that your pile of money earns enough interest, or return, to cover all your expenses. Most people never come even close to this.

Instead of stockpiling and investing excess money, most people justify spending limited money on "nice" things, even when they have no money or net worth whatsoever, by rhetorically asking the question, "Why should I live a "deprived" life?" They want to have nice things, like "everybody else." So, they work their minimum or average wage jobs, collect government handouts wherever possible, cling to tax returns and writeoffs, and blow whatever money they have left after their bills are paid on stuff that the "rich" have, just to make themselves feel less deprived.

Well guess what: It's not these "things" that make the "rich" rich. They're rich because they saved their money when they had little of it, and later put their money in things that earn them more money. It's called "investing." Yes, quite a novelty!

The poor and middle class are keeping themselves there by thinking they are imitating the rich! In essence, they picture this as happiness:

All I see is this:

In case you have any question about hat constitutes "sucking" at money, consider the below as starter suggestions:

- Having too much money that it becomes no object, so you waste it

- Having too little money and wasting it on things that make you poorer

- Having obsessions with crap you don't actually need--like an iPad-Phone-Watch-TV, big TV's, jetkis or four-wheelers in the garage, etc

- Buying crap you can't afford, with money-sucking debt and paying interest--cars, an outrageous house, and other expensive toys

- Giving your children an ivy league lifestyle from cradle to career

- Getting an education that won't help you earn a decent living, and incurring unaffordable student loan debt

- Constantly relying on government assistance for your livelihood

- Not religiously setting aside an aggressive percentage of your gross income each month into savings toward your early retirement

- Not having a financial plan to get and stay out of debt

- Not saving cash for emergencies, like job losses or medical issues

- Not having a budget, in order to track expenses and reduce them

- Not minimizing unnecessary expenses

- Making unwise investment decisions with your hard-earning savings

- Not knowing how much money you need to retire

- Not having a financial plan for when you want to retire, or taking steps to get there

- Having to work until you are 65

But before I bog you down with boring math, I'll reveal to you my "vision" for your financial future of freedom.... read on brave warrior!

Freedom and prosperity begin now! Pick your poison below...

Freedom and prosperity begin now! Pick your poison below...

0 comments: