Getting Ravaged Everywhere You Go

In Parts 1 and 2, I introduced the truth of the world to you.... which is, that you're living in a world of shysters who are constantly groping for a chunk of your wallet at every turn. This series concludes today, with the rest of the details below...

___________________________

The truth is, we're living in a world of shysters who are constantly

groping for a

chunk of our wallet at every turn. And it's always been my opinion that

if you get taken advantage of, frankly, it's your own fault for not

doing your "homework."

The truth is, we're living in a world of shysters who are constantly

groping for a

chunk of our wallet at every turn. And it's always been my opinion that

if you get taken advantage of, frankly, it's your own fault for not

doing your "homework."Turn on your TV, swipe open your tablet, walk out your front door, or drive down your street. Individuals, businesses, and organizations are bent on getting as much of your hard-earned greenbacks as possible using advertising, psychology, convenience, bright signs, and even fear to coax you into having or buying things that won't lend you freedom, security, or give you lasting satisfaction.

The bamboozling cacophony of voices have no shame at all in making sure you stay poor, stupid, and chained down to a lifestyle you probably never really wanted. It's sickening to think about.

There are hundreds of them out there, barely perceptible... it's like a living conspiracy theory. And the more stupid, ignorant, and lazy you are, the easier it is for you to get hoodwinked into forking over your wealth to some conniving shyster who doesn't deserve it.

These are the "taxes" I'm referring to--"tolls" you pay for making poor choices, or falling for wealth traps.

Not long ago, I read that many wealthy people making over $1 million a year pay absolutely zero in income taxes. Why is that?

They've figured out how to legally play the system in their favor, in order to avoid getting raked over the coals by the same machine that keeps the average Joe in the poorhouse.

Basically, they've learned how to avoid taxes on stupidity, ignorance, and laziness.

I want the same for you. You may not be wealthy yet, but someday you will be, if you play your cards right by making smart money decisions.

And after today, your eyes will be opened to ways the world takes advantage of you, the middle class, and keeps you poor in a micro-spending level. Consider this a wake-up call for ditching that lifestyle like a bat out of hell, and starting down the road to wealthiness by saving better, spending less, and investing your money like smart people do.

Here's a list of what I'll talk about in this, the conclusion of this article series:

- Taxes on Personal Finance Illiterates

- Taxes on the Poverty-Minded

Time Value of Money (Reviewed from Parts 1 & 2)

As I continue to address all of these things, remember what we talked about in part 1 and 2 about the Time Value of Money. If

you have a $5 bill in your wallet right now, it's worth just $5. But

what's it worth next year if you put it in a savings account or

investment?

If

you have a $5 bill in your wallet right now, it's worth just $5. But

what's it worth next year if you put it in a savings account or

investment?A savings account would make that $5 worth $5.05 next year. In an investment account, if we estimate an average yearly return of 12% (the return of the standard stock market index over approximately the last 70 years), your $5 is actually worth $5.60 one year from now. If you take $5 every year then, and invest it in the market, $5 per year over 40 years is worth $4295.71. Crazy, right?

That's the concept of "time value of money" in a nutshell.

We'll be putting all of the below "taxes" into this same lens to determine how much wealth you might be foregoing over for each of these areas over the course of 40 years.

Taxes on Personal Finance Illiterates

Banking Overdraft fees

Due to recent changes in consumer financial protection laws, banks are now required to ask your permission to "opt you in" to overdraft fee collection when you first open an account with them. If you don't opt in, the bank will not allow transactions to go through at the supermarket if you spend more than what your current account balance is.

Due to recent changes in consumer financial protection laws, banks are now required to ask your permission to "opt you in" to overdraft fee collection when you first open an account with them. If you don't opt in, the bank will not allow transactions to go through at the supermarket if you spend more than what your current account balance is. Checking Account Fees

Many institutions still give free checking, but only if certain conditions on the account are met, like having a regular direct deposit, keeping a minimum balance, use of mobile banking, having a debit card, and receiving electronic account statements. Anytime these conditions aren't met, you get dinged.

Many institutions still give free checking, but only if certain conditions on the account are met, like having a regular direct deposit, keeping a minimum balance, use of mobile banking, having a debit card, and receiving electronic account statements. Anytime these conditions aren't met, you get dinged.ATM Fees

- I keep a stash of a couple hundred dollars in cash at my house for when I need it at home. I keep it all in small denominations like 5's, 10's, and 1's.

- I plan ahead if I'll be traveling abroad--I stop by my bank to withdraw as much cash as I'll need for the entire trip, if I need any at all. Credit Cards with VISA on them are accepted worldwide, usually with no fees.

- For unexpected times when I need cash and I'm not at home, I stash a $20 bill in a wallet pocket I almost forget exists. I keep one there for emergencies--in fact, a couple times when I've needed it, I really did forget it was there.

- I store cash inside my phone, in case I forget my wallet on quick trips to the store. I flip open the battery case in back, and put a $20 bill there, safe and sound. If you own an iPhone and the back of the phone doesn't open, stash it in the phone's protective case, most of which these days actually have credit card slots for storage.

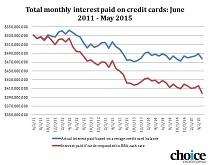

Credit Card Interest

Not a dime in interest paid... the credit card companies hate people like me. They love the people they scam month after month, and that sure isn't me (anymore).

What does it cost you in wealth to carry a credit card balance? The average credit card household debt in the US is around $16,140 for 2014. At interest rates approaching 15%, that's $2421 a year, or $2,079,983 over a lifetime. That's an insane amount of wasted money.

What does it cost you in wealth to carry a credit card balance? The average credit card household debt in the US is around $16,140 for 2014. At interest rates approaching 15%, that's $2421 a year, or $2,079,983 over a lifetime. That's an insane amount of wasted money.Consolidation Loans

Typically, these consolidation loans are an interest trap.

In order to find out if your is, you have to know how much interest you were paying on the other three loans combined, and compare that with the interest you'll be paying (both monthly, and in total) with the new loans.

The bottom line is, will the new loan cost you less in interest every month, or in total for the long run? In many cases, the answer could be "yes", especially if you have high-interest debt like Payday Loans and Credit Cards, because the consolidation loans are usually much lower, somewhere in the range of 8-12%. Do the math, and figure out if it makes sense.

The bad news is, many institutions offer consolidation loans, not to lower your interest, but to lower your payments, which does nothing more than spread out payment of principal and interest over a longer period, costing you MORE money than before.

The institution where I work (a credit union) does a lot of consolidation loans, but operates honestly and transparently. I have assisted them in developing our systems to more accurately calculate whether a proposed loan consolidation is in the best interest of our members. When it's not, we don't do it. But, I have seen many loans held at other institutions where this was not the case.

I've observed that on average, my company saves members around $100 a month in interest by bringing over these loans. If that's standard across the industry, and you have consolidation loans currently outstanding, these could be causing you to forego $1200 a year, or $932, 473 in established wealth over a lifetime.

Again, this isn't chump change we're talking about.

Credit Reports and Scores

Keeping a good credit score isn't essential in today's society, but it does simplify things for you, and allows you to live life on the cheap, especially when it comes to auto loans and home mortgages. Keeping a good score requires not only good financial habits, but also credit history and score monitoring.Have you paid recently to get a copy of your credit report, or your credit score? Well, you shouldn't have. Both can be had for free. These two things (the report and the score) are actually separate, and it's important to understand the difference.

A Credit Report lists any accounts or loans you have open under your Social Security Number. You should check this report at least once a year, to make sure that no one out there has opened any accounts in your name without authorization. And it can be obtained FREE once a year. You are legally entitled to this. Go to https://www.annualcreditreport.com/ to get your report from all three Credit Bureaus. It is FREE ONCE A YEAR.

Here's a tip from the Pro's: even perform the check for your kids. Theft of child social security numbers is on the rise, and it could be extremely damaging for a child to try opening his first credit card at age 18, only to find out someone has been tainting their credit history for a decade.

Now for Credit Score. Have you ever paid to get it? If so, you probably got ripped off. Did you know that your bank can actually provide your credit score for free to you, almost anytime? Most financial institutions where you hold loans, or even checking accounts, typically pull your credit score every few months to make sure the risk on any accounts they have with you isn't increasing. You can sit down with a banker at your institution, and it's likely they have it available to you right there on the spot. No Questions Asked. I know that to be the case where I bank, which is the same company I work for.

If you currently pay for credit reports, stop it now. By law, companies cannot charge you more than $12 for your credit score and report. That's not much, but still--if you do that every year, you've forfeited $9,324 in wealth.

Taxes on the Perpetually Poverty-Minded

Letting someone else manage your money

Never trust your wealth to someone else. They don't care as much about your financial freedom as you do--and they charge you an arm and a leg to do it.

If we stick solely with the fees associated with letting someone else manage your wealth, we could easily assume you're going to save thousands of dollars per year--and that number will only climb once your wealth becomes more substantial. But for the sake of illustrating for this article, let's stick with a nice, round number of $2000 per year.

By managing your own money, you'll keep $1,554,122 over the course of your lifetime.

Read the articles I have on learning to invest, and you'll be two steps away from complete independence from incompetence.

Playing the Lottery

Spending $5 a week on the Quick Pick is akin to whistling money into oblivion. You might as well light a Five-Dollar bill on fire on your front lawn. It's just as fun as purchasing a ticket and never winning it big.

Spending $5 a week on the Quick Pick is akin to whistling money into oblivion. You might as well light a Five-Dollar bill on fire on your front lawn. It's just as fun as purchasing a ticket and never winning it big.Five dollars a week on lottery tickets comes to $260 a year, or $202,035 in wealth which you could have accumulated simply by buying and holding stocks long term over your lifetime.

Not Putting Your Savings on Auto-Pilot

I'm talking about 401k and other retirement account matching most employers offer. Many companies will match--dollar for dollar, up to a certain percent of your paycheck--any money you contribute to retirement. This employer match is a 100% RETURN ON INVESTMENT. Guaranteed. You will never find a better way to make money than that.

How much are people giving up by not taking advantage of employer matching? At an average salary of $52,000 a year, with an employer match of 5%, many are forgoing $2600 a year, or $2,020,359 in FREE MONEY.

Not Learning to Invest Yourself

Unfortunately, there's simply no way to estimate how much more wealth and freedom you can accumulate by being a savvy investor--its more money than you can imagine.

Conclusion

Let's recap the amount of wealth we've decided not to forego with today's article.

- Shun overdraft fees: $85,914

- Maintain your checking account fee-free: $42,957

- Stop paying ATM fees: $34,365

- Ditch Credit Card interest: $2,079,983

- Consolidation loans: $932, 473

- Get free Credit Reports and Credit scores: $9,324

- Learn to build wealth on your own: $1,554,122

- Quit playing the lottery: $202,035

- Put savings on auto-pilot: $2,020,359

- Invest like a pro: ???

Part 2: $4,512,645

Part 3: $6,961,532

Total: $18,750,247

I know what you're thinking... that looks like a ridiculous amount of wealth, and it sure is. But it's just an illustration of what can be accumulated if we cut out "the fat" in our lives.

If nothing else, these three articles you've just read should serve as a lesson in opportunity costs. By giving up one thing in life, you gain another.

I hope that you have a bit more of a perspective on this concept now, and a few ideas you can use to make your life more full, more free, and more simple. That's the true reason I maintain this site... not only to help you all attain true and lasting freedom, but to make sure that's something I keep focused on myself.

Live long and invest,

Jeremiah

Freedom and prosperity begin now! Pick your poison below...

Freedom and prosperity begin now! Pick your poison below...

0 comments: